Regular readers will remember that we reported on proposals to revise the European VAT Directive. This currently requires all Member States to have a standard VAT rate of at least 15%, with a list of products that Member States may choose to tax at lower rates or that are exempt (such as postage stamps).

Before the UK joined the EEC (as it was then), the British Government levied a Purchase Tax of 25% on luxury goods (down from its highest rate of 100% as part of wartime measures to reduce wastage of raw materials). When introduced, the standard UK VAT rate was set at 10% for most goods, but it has fluctuated considerably since, with different products being subject to higher or lower rates.

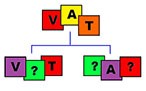

The UK “temporarily” increased its standard rate to 20% in 2011 for most goods and services. There are two other rates: 5% on items such as home energy supplies, children’s car seats, and equipment for disabled persons; and 0% for most food (both human and animal, though not snacks and alcohol), children’s clothes and other items deemed to be essential.

Certain people are now arguing that lower VAT rates should be used to promote the circular economy. Rates of 7% or even zero have been proposed for the most “resource-efficient” products, with other rates varying according to their level of environmental friendliness. This presupposes both an agreed harmonised rating system for environmental impact (still in its visionary stage) and a willingness by governments to forgo tax revenue in the interests of saving the planet.

The Commission’s final proposals are expected in the autumn.